ARTEMIS Group is an international and cross-sector Corporate Finance and M&A Advisory Boutique

ARTEMIS Group is an international and cross-sector corporate finance and M&A advisory boutique for start-ups and medium-sized companies, active in the market since 2001.

As a strong partner at your side, we will guide your company from its first venture capital financing rounds to subsequently following expansions financings to classical corporate finance and M&A projects and lead you through each one of there complex processes with individual and creative solutions.

Our long-term client relations are built on trust, reliability, engagement and close, collaborative partnerships. We particularly rely on an experienced, highly qulified team as well as our excellent global network.

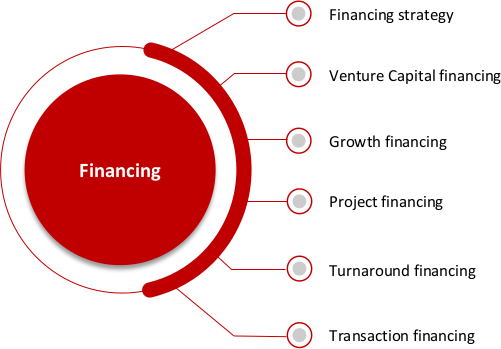

ARTEMIS advises corporates as well as financial and private investors on capital optimization and funding strategies.

Every financing opportunity offers a variety of financing instruments and sources as well as capital forms. With our collaborative and integrated approach to projects and transactions, clients benefit from our expertises, employees long-term experience, excellent market contacts and international networks.

For established medium-sized companies or newly founded start-ups we combine the available instruments as efficiently as possible in every specific financing situation.

ARTEMIS not only provides the right financing strategy, but also actively supports the selection of capital providers and assists in the realization of financing.

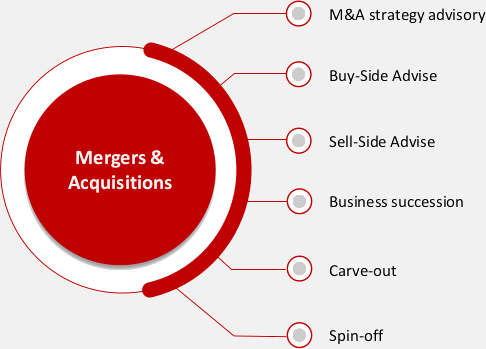

ARTEMIS advises corporates as well as financial and private investors on Mergers & Acquisitions transaction services and strategic advisory.

In view of the increasing globalization, structural adjustments in the industries or upcoming corporate successions, Mergers & Acquisitions transactions are becoming increasingly important – not only for large corporations, but also for medium-sized companies.

Corporate transactions are usually complex and time-critical. Success factors include thorough preparation, a result-oriented transaction strategy, discretion, and an experienced team that professionally manages the process and has the necessary assertiveness.

ARTEMIS has the insight and experience to advise its clients through each stage of the Mergers & Acquisitions process. Starting with the development of the appropriate strategies to create the best value from every transaction.

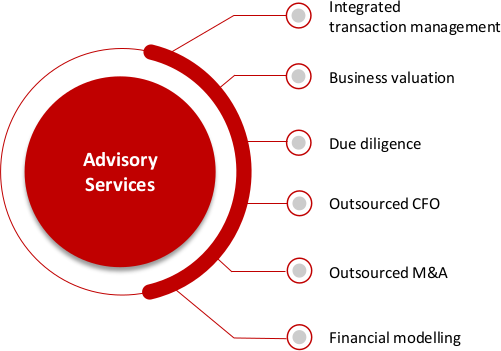

ARTEMIS advises corporates as well as financial and private investors on a range of advisory services related to Mergers & Acquisitions and corporate finance.

ARTEMIS supports on all aspects of integrated management of transactions, valuation of companies or assets and due diligence.

Based on many years of project-proven methods, concepts and processes, ARTEMIS supports from the first financial modelling through to company evaluation. The finance and transaction expertise is complemented by industry and functional experts.

As part of Mergers & Acquisitions transactions, ARTEMIS offers integrated transaction management and due diligence support.

For small and medium-sized companies, ARTEMIS outsources entire CFO activities and Mergers & Acquisitions office activities.